3D

Services

At Dastan Artifex, we provide 3D Product Rendering Services to clients for a wide range of needs. We specialize in product modeling, rendering, and animation as well as things like character animations that can be used on the web or in VR immersive environments.

Showreel

We produce world-class product animations for our clients by using pioneering technologies and a dedicated group of skilled artists who are experts at bringing your content to life.

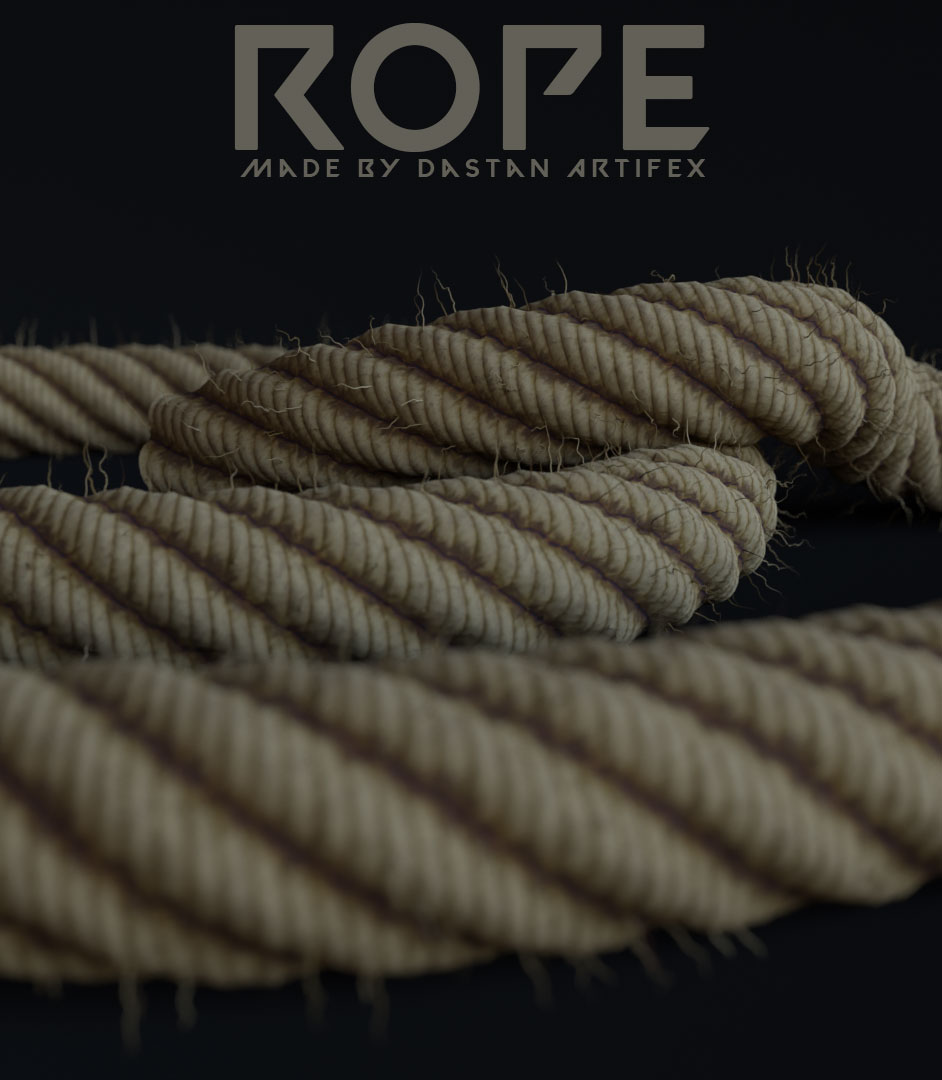

3D

Modeling

Creating everything from concept cars to luxury watches. Making textures that can be used for any material type; fabric, stone, or metal. Our years of experience in 3D animations are just a click away to add more value to your business branding.

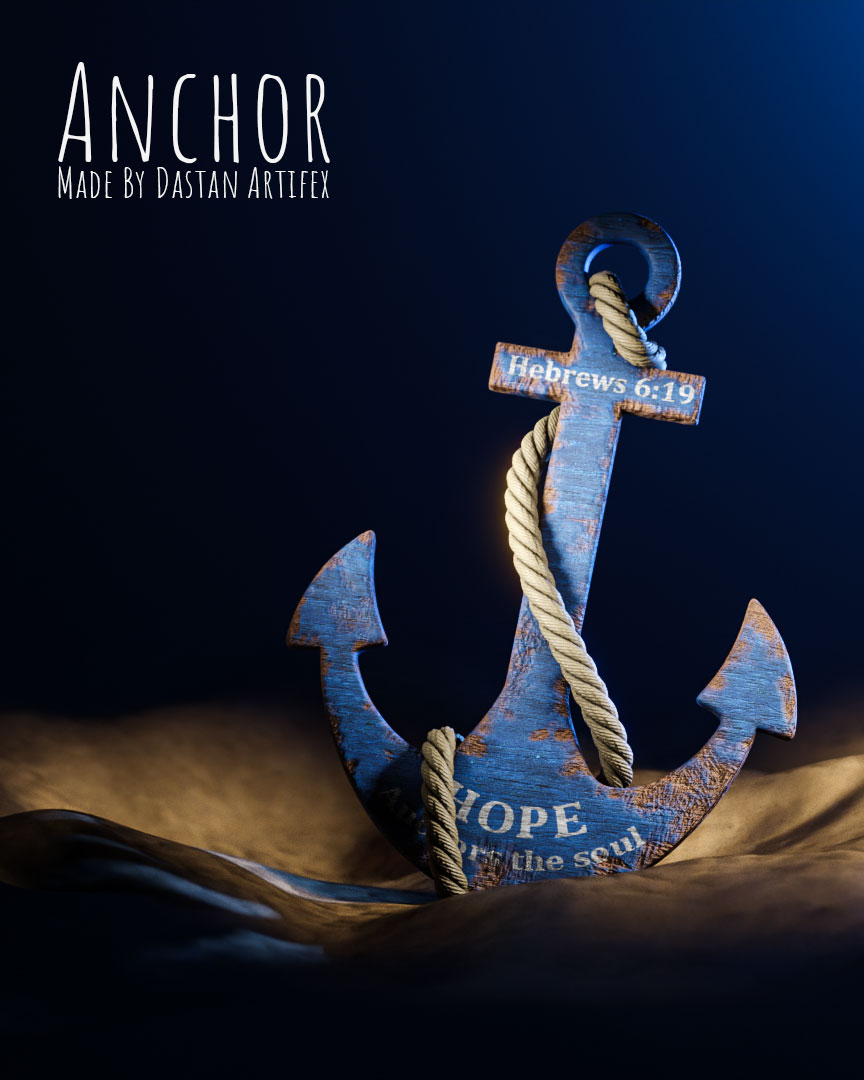

Product

Rendering

We specialize in product modeling, rendering, and animation as well as things like character animations that can be used on the web or in VR immersive environments.

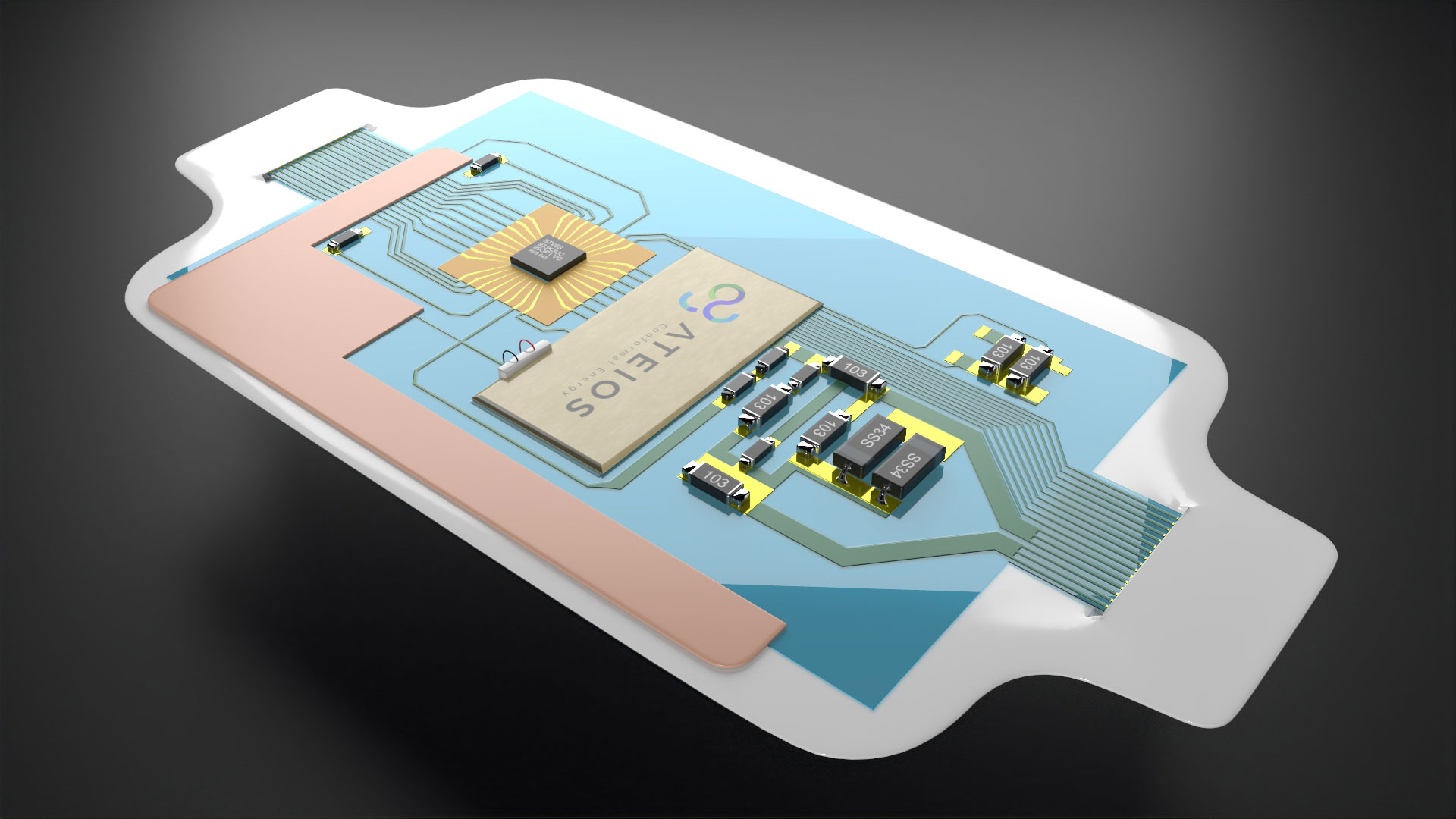

Expend

Your Product

Features

Secure Yourself!

2015

We have been in the market for the past 8 years, and one crucial realization from our experience is that Quality and Value are of utmost importance to our clients.

400+

With over 400 clients, we firmly believe in the value we bring to your business. That’s why we offer negotiable prices and strive to work within your comfort zone, all with the goal of enhancing the benefits we provide to you.

Some Precious words about our services

I have been looking for the right one for 3D modeling and animation for a long time. Dastan Artifex exceeded my expectations. It was not only perfect work but also a professional attitude, and excellent communication, and all in a short time. No unnecessary guesswork or complications. Everything went smoothly. I really appreciate this freelancer and recommend it to everyone.

- Accellsoft

Song

Animation

NO ME BUSQUES (feat. El Cherry Scom & Lozanology) by D2OS

NFT Variations have emerged as the most popular form of Artwork.

Recently, we have been actively engaged in numerous NFT projects. Our expertise lies in designing models and skillfully combining multiple traits to create stunning renders in Blender. What sets us apart is our commitment to authentic rendering of NFTs, avoiding the use of Photoshop shadows or artificial blending with scripts. When you hire us, you can expect genuine and original artistry.

VR/AR

360° Model

Configurator For Websites